Vehicle insurance myths are and one of them is that the color of your car matters a lot in your insurance premium or total value. Such thinking applies mostly to bright colours like red and yellow and has existed for years, but it is completely untrue. Insurers mainly focus their attention on all the risk-related factors and do not care about how the colour of the vehicle will determine the insurance premium.

What do insurers look at?

Insurance companies consider multiple measurable risk factors before concluding the premium. Such aspects as the make and model of the car, year of manufacture, engine specs, and safety features are all taken into consideration.

Further, critical components would include your age, your driving records, your geography, or the frequency of use. What all those factors want to achieve is to estimate the risk of accidents, theft, or costly repairs, while none of them indicate what one drives by paint.

Why does this Myth exist?

The myth that the colour of a car affects insurance somehow comes from the psychological linkages with particular colours. Black, for example, on the other hand, tends to be considered sporty or aggressive in cars, thus making assumptions that people will drive black vehicles faster, or they’ll have more accidents because it will blend with the colour of night. However, these assumptions are not the basis for calculations by insurance companies. Insurance companies use data-driven approaches.

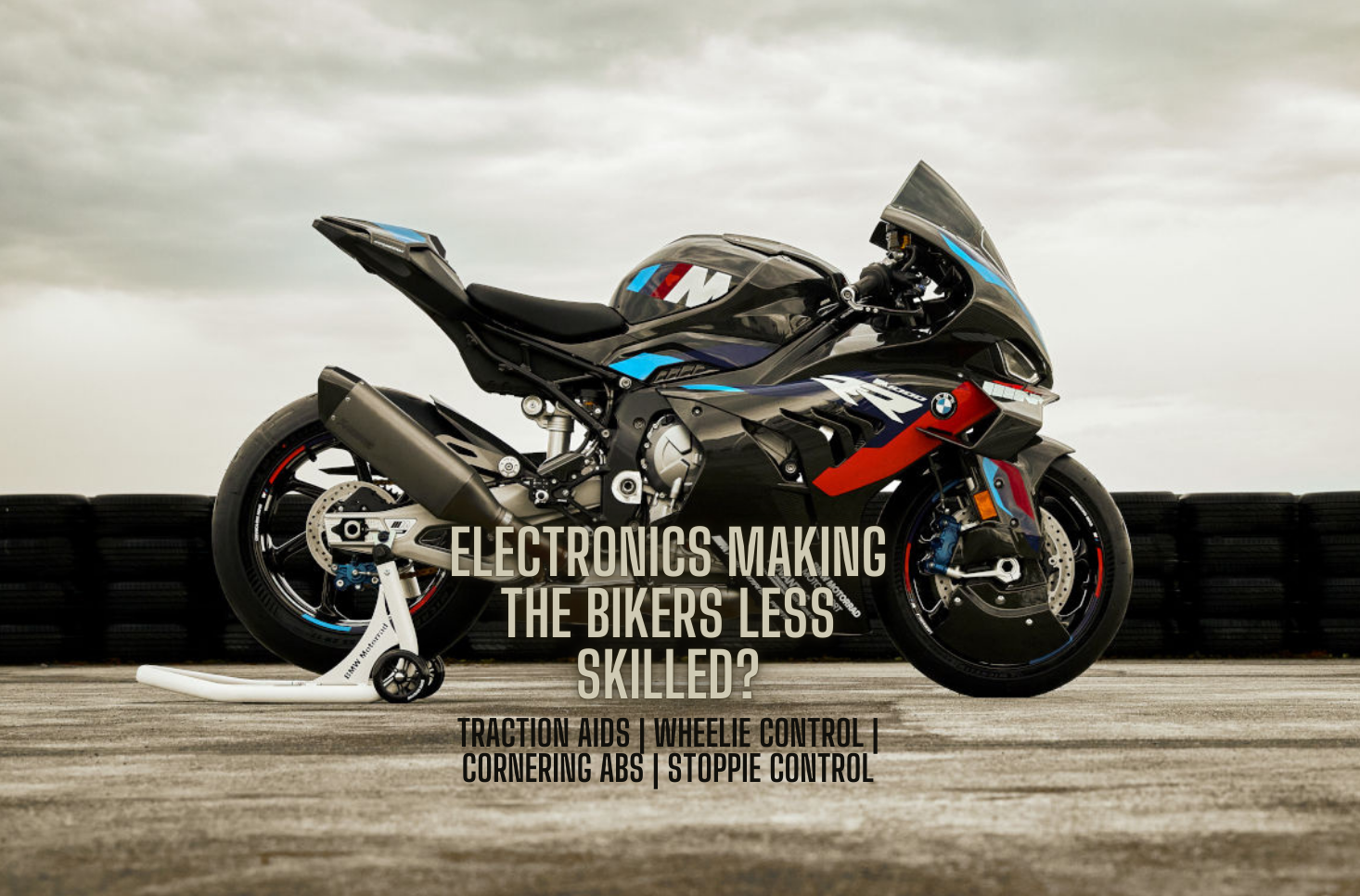

Next: Why racers delete ABS?

Choose right tyre for your motorcycle! Truth behind it

[…] Next: What factors define your Insurance premium? […]